It’s time to…

repair your credit!

Dallas Texas

Ready to sign up? Click one of the buttons below to enroll in one of our Credit Repair Programs.

Option 1: Monthly Credit Restoration Program for $250 down and $100 a month for 6-9 months

Option 2: 90-Day Fast Track Program for $1,500.

CREDIT REPAIR IS CONSTANTLY CHANGING

Credit reporting laws have changed and you need an expert to assist you with removing negative and derogatory information from your credit reports.The process of credit repair has changed and most companies strategies and tactics are a thing of the past.

The process of using letters to dispute negative accounts not only does not work but it also may not help your score. Accurate and verifiable information cannot be removed, but some companies claim to do so. There are often situations when removing what appears to be a negative account can actually lower your credit score because other aspects of the account are helping your score. If raising your score is your goal, you must be educated on and understand the categories that make up your FICO score.

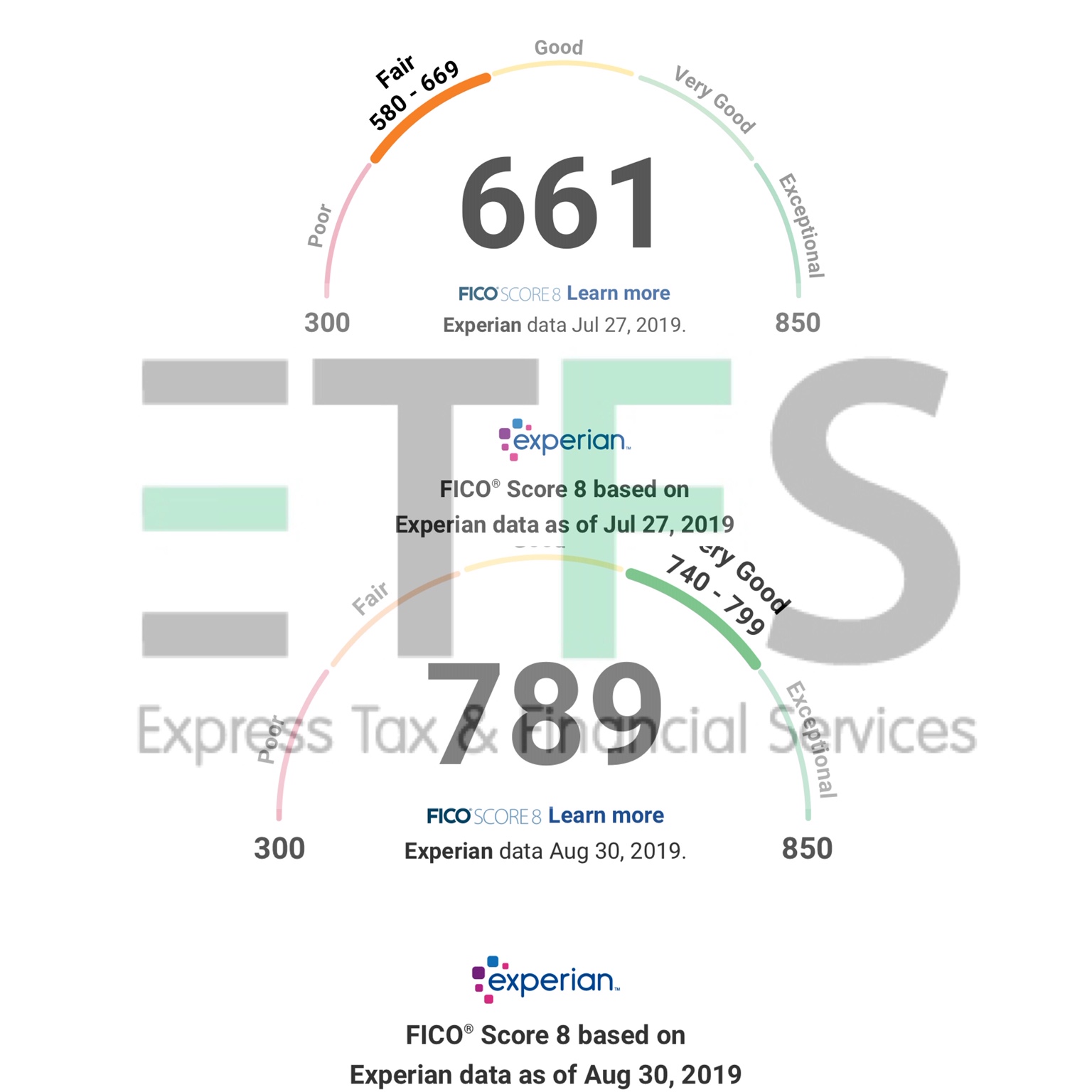

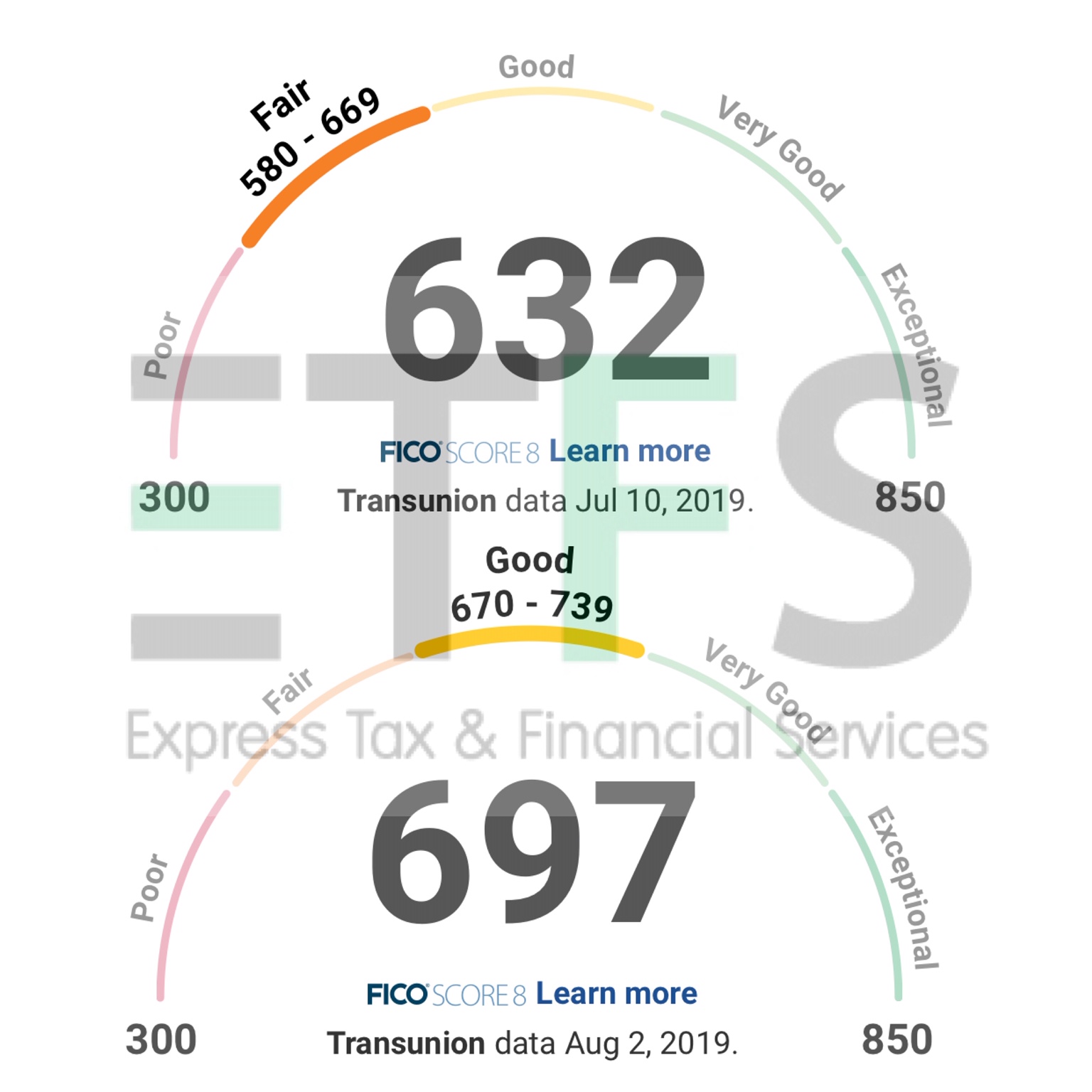

Our fast and proven process was designed to raise your credit scores by as many points and as quickly as possible by

verifying the accuracy of accounts through multiple strategies. Our process includes challenging ALL credit bureaus NOT limited to just Equifax, Experian, & Transunion. There are several other reporting agencies that are holding your negative records we provide direct audits on those agencies reports.

By disputing and removing inaccurate, erroneous, misleading, outdated, unverifiable negative accounts with the credit bureaus and creditors, our clients see remarkable results. By removing negative information, and maintaining the perfect utilization, not only will you see a change in items, but also an increase in scores!

We work on 100% of your credit score! While others only send out dispute letters, they are working on 1/3rd of your total score. We work on all score categories, 100% of your total FICO score. Our credit coaches work with you on the things that make up your total score. We make sure you have the right mixture of accounts and your balance-to-limit ratio on open accounts is just right. And our processing team never disputes items that could lower the average age of your accounts, and they dispute ALL INQUIRIES! Those that say they coach customers in this area do nothing more than suggest you open a secured card which could actually hurt your score by damaging your credit mix, lowering your average credit age, and add an inquiry. Our credit consultants, are trained professionals and understand the makeup of credit scores, and they consider many factors when working with you.

Our team will review your credit reports and then direct appropriate correspondence to your creditors and the credit bureaus using these laws. Your credit report items are carefully triaged and matched with just the right credit repair strategies, as applicable to your case. Although some consumers think only “send in a credit bureau dispute” when they hear the phrase “credit repair,” the truth is a bit more complex. Good credit repair includes numerous tactics and approaches, many of which don’t even involve the credit bureaus.

THE FTC MANDATES ALL ITEMS ON A CREDIT REPORT MUST:

REPORT 100% ACCURATE INFORMATION

All aspects must be correct, apart from the fact they exist. They must report dates, balances and history PERFECTLY- most credit furnishers are violating your rights due to bad bookkeeping.

REPORT TIMELY INFORMATION

There is a time limit for information that we request. You have to force credit furnishers to stick to the legal reporting time.

REPORT ONLY VERIFIABLE INFORMATION

“If they can’t prove it, they must remove it”- creditors and collection companies must, by action of law, prove that they have the right to report the information, which is very difficult due to continuing bank mergers, bad record keeping, employee turnover or negligence. “If we ask for a specific item and don’t get it, odds are it will be removed!”

HOW LONG WILL THIS TAKE?

Tradition monthly pay-as-you-go programs takes 4-6 month results seen in as little as 30 days. The Fast Track program down payment with final payment upon Day 60, takes less than 90 days. Results seen in as little as 30 days.

OUR PROCESS:

In order to provide you optimal results we must review your credit. Customer must sign up for credit monitoring and provide the login credentials via our secure client portal. Once, we review the customers credit we provide a free credit analysis which explains what is on the individuals credit and what negative/derogatory items need to be removed. From there the client will speak with an agent and determine which program they are signing up for. We then enroll you and send you your contract for credit repair services.

Dallas Texas

What are the Consumer Protection Laws?

The FCRA (Fair Credit Repair Act) affords consumers protection against disorganized credit bureau records and regulates how the credit reporting agencies treat customers.

The FCBA (Fair Credit Billing Act) requires creditors to bill only correct information about you. You can challenge and question dates of charges, payments, proof of purchase and more. The dispute possibilities are endless when it comes to the FCBA.

The FDCPA (Fair Debt Collection Practices Act) places limits on how 3rd party debt collectors behave. With the collection industry being a billion dollar business, and with more creditors needing help with collections after the credit crunch of the mid-2000s, unethical business practices by collectors are worse than ever. Collection companies must follow strict rules and guidelines, but they threaten people and break the law every day.

As you can imagine, these three Acts alone give you an arsenal of legal dispute tactics when used correctly.

Monthly Credit Restoration Program

Credit Repair completed in a 6-9 months process includes free credit analysis and credit recommendation. Unlimited disputes. Access to secure client portal to monitor credit results. Down-payment of $250 and $100/month after.

Fast Track Program

Credit Repair complete in a 60-90 day process includes free credit analysis, credit recommendations, unlimited disputes, and access to secure client portal to monitor credit results.

Tradelines

Variable rates — Reliable, seasoned tradelines at affordable prices. Authorized User Tradelines are credit accounts that can allow you to increase your credit scores. The account holder adds you to their account allowing you to increase your score and the tradeline goes on your credit.

Credit Repair

Personal: Monthly program $250 down at start of service then $100/month or $1500 for fast track program 60-90 days — Removal of negative information being reported on credit reports with all three bureaus. Including: inquiry removals, judgement removals, bankruptcy removals, student loan removals and more.